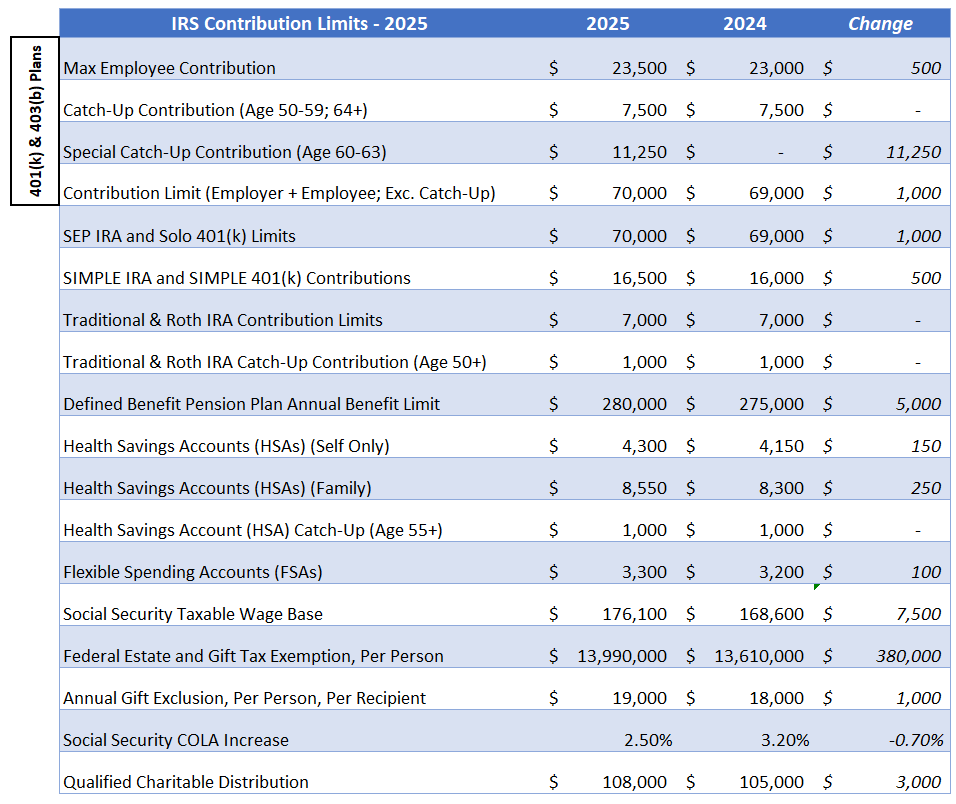

2025 401k Contribution Limit Irs. The new limit is $23,500, up from $23,000. The limit on annual contributions to an ira in 2025 remains $7,000, the irs said.

The 401k contribution limits for the year 2025 are expected to see many increases in different plans including elective deferral limit to $24,000, defined contribution. These changes apply to 401(k), ira, simple ira, and sep ira plans.

401k 2025 Contribution Limit Chart 2025 Bruno Ashton, The maximum annual benefit under a defined benefit.

Contribution Limits 2025 401k Olivia Jade, Eligible taxpayers may contribute up to $23,500 to their 401(k) plan during the year.

2025 401k Contribution Limits Irs Amira Rose, The irs has also announced the individual retirement account (ira) limits effective january 1, 2025.

Catch Up 401k Contribution Limits 2025 Santiago Caleb, The new limit is $23,500, up from $23,000.

What Is The 2025 401k Contribution Limit Nolan Kamal, The 401k contribution limits for the year 2025 are expected to see many increases in different plans including elective deferral limit to $24,000, defined contribution.

Irs 401k Catch Up 2025 Emilia Hope, Eligible taxpayers may contribute up to $23,500 to their 401(k) plan during the year.

2025 IRS Contribution Limits For IRAs, 401(k)s & Tax Brackets, In 2025, the 401(k) contribution limit for participants is increasing to $23,500, up from $23,000 in 2025.

Catch Up 401k Contribution Limits 2025 Santiago Caleb, For the 2025 tax year, the irs is increasing the annual contribution limit for 401(k) plans by $500 from the current limit of $23,000 in 2025 to $23,500 in 2025.

2025 401k Contribution Limit Calculator Single Emilia Hope, Additionally, the total contribution limit for defined.

Max 401k Contribution 2025 And Catch Up Contribution Limit Tiff Adelina, The standard 401(k) contribution limit for employees will rise to $23,500 in 2025.